December cut fully priced after softer consumer data

One must interpret current US macro updates with caution given the disruptions to data gathering associated with the government shutdown. Nevertheless, the totality of the releases this week sent a cautionary message on the consumer and a “more of the same” message on inflation.

The good news was that unemployment claims pulled back a little in mid-November, implying that the labor market is not in an acute phase of deterioration. The Conference Board labor differential—the difference between respondents saying jobs are plentiful and those saying jobs are hard to get—worsened a little but remains about a point above its September level. This seems to suggest a holding pattern, even if a precarious one.

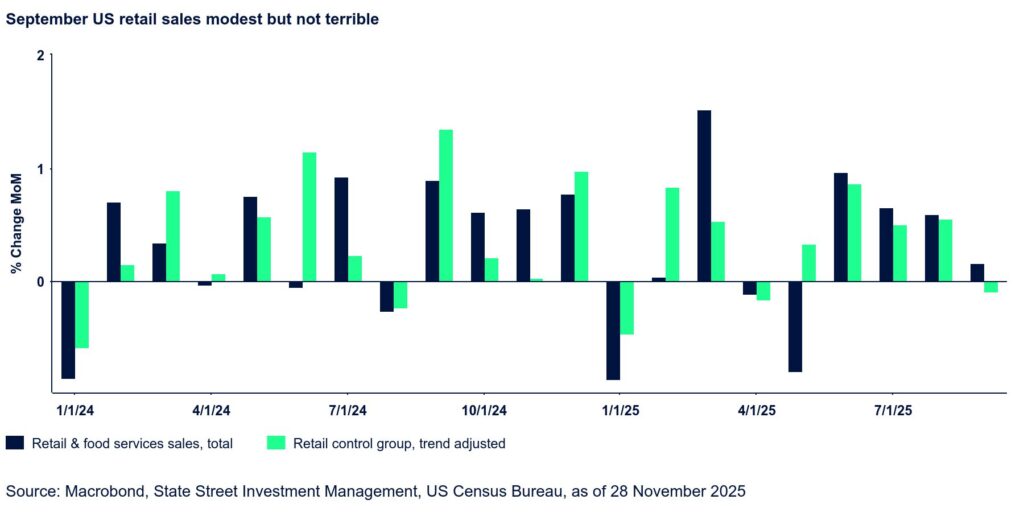

The more troubling sign came from retail sales and consumer confidence, although there is no reason to panic. Overall retail sales rose a modest 0.2% MoM in September, and control sales (sales excluding food, gas, building materials, and dollar stores) contracted 0.1%. While these readings undershot consensus expectations, they aren’t altogether shocking given the extended government shutdown that impacted the whole of September. More troubling is the fact that a retreat in motor vehicle sales in October could portend another soft print; moreover, the fact that consumer confidence dropped visibly in November means the soft patch could extend well into the fourth quarter.

On inflation, the PPI update was mixed but reassuring overall. Good prices rose 0.9% MoM, partly on account of higher gasoline prices, but core goods prices advanced a moderate 0.2%. Services prices were flat, allowing services PPI inflation to ease to 2.5% YoY, the lowest reading since February 2024.

The net result of all this was that investors ended the week fully pricing a December rate cut, which had remained our call all along.