Fake resilience is how we would describe the September payrolls report, released more than a month after the originally scheduled date.

The economy added a better-than-expected 119k jobs, though this was accompanied by another downward revision (-33k) to the prior two months. Unfortunately, we have no guarantee whatsoever that the 119k print wouldn’t itself have been revised with the October update…but we won’t know that because the October employment report will not be made available due to the government shutdown.

That said, both the ISM surveys had suggested ongoing weakness in employment, for instance. Wages were soft: for production and non-supervisory employees, this was the softest monthly gain since March (and prior to that April 2024). The wage inflation rate for this group eased another tenth to 3.8% YoY, the lowest since March of 2020.

Weekly hours were weak overall and were very weak in manufacturing, dipping below 40 for the first time in a year; this follows an even larger decline in August. Aggregate manufacturing hours were the lowest since January 2022. Yet, the payroll report puzzlingly indicated a rise in manufacturing employment…so why are firms hiring, if not to use these workers productively?

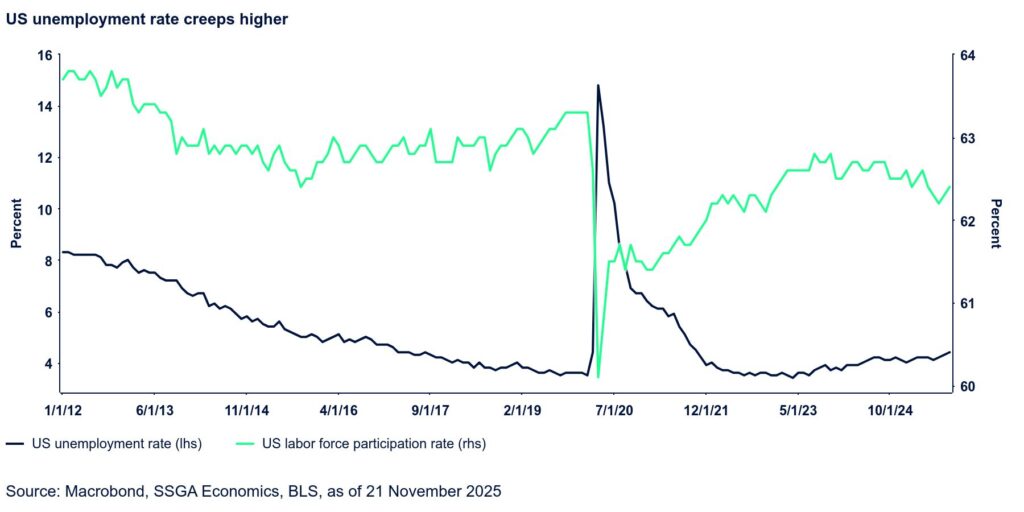

Finally, the unemployment rate rose by a tenth (and was just hairbreadth away from rising two-tenths) while the participation rate rose. The balance of risks, given all that we know, including the fact that about 75k former federal government employees who took the deferred DOGE deal would come off government payrolls in October, imply a meaningful dip in overall employment in October.

The Fed may not have the benefit of the actual data in hand before the December meeting, but that does not alter reality.

We are focused on downside risks in the labor market, and the Fed should, too. Another cut is needed before the Fed pauses subsequently to allow the gradual normalization of data flow to guide the timing of the 2026 cuts.

We were glad to hear New York Fed president John Williams making some dovish comments in this direction on Friday, which doubled the market-implied odds of a December cut to above 60% on Friday.