Layoffs say caution, not panic

While the government shutdown continued, there has been a welcome uptick in the number of macro data updates during the week of November 3. The messages were mixed. On the upside, the ISM non-manufacturing index came in stronger than expected, offsetting the tepid manufacturing reading. But motor vehicle sales declined by over one million (seasonally adjusted annualized) to 15.32 million in October. It is too soon to worry given that the holiday shopping season is yet to fully begin, but it is a reminder of downside risks to consumer spending in an environment of expensive credit and softening labor market.

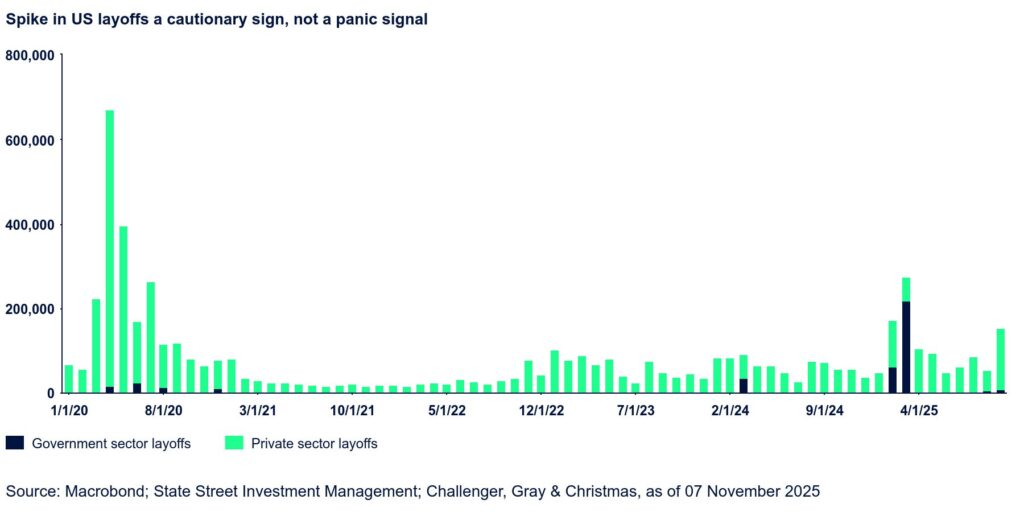

On that last point, the reported spike in October layoff announcements from Challenger, Gray & Christmas grabbed a lot of attention. While government sector layoffs remained low (as we’ve been arguing despite threats thereof during the government shutdown), private sector layoff announcements tripled from September and from a year earlier.

The data matches a string of recent layoff announcements from large US firms, some of which have been linked to AI deployment. As such, they need to be taken seriously; in light of this, there is no reason for the Fed to skip the December cut. At the same time, it is also not wise to panic, given that hiring announcements also jumped during the month so the net labor market deterioration implied by the totality of the data is less intense.