This week’s economic outlook highlights US government layoffs amid a shutdown

Not DOGE 2.0, but still a risk

With the government shutdown heading into its second week, a number of key economic data releases—including the premier employment report—have been delayed. Naturally, attention has shifted to various relevant private data sources, all of which indicate a labor market lacking vitality. The ADP report, for instance, showed a loss of 32k jobs in September, though its correlation with headline payrolls data is fairly loose, so this number should be taken with a grain of salt.

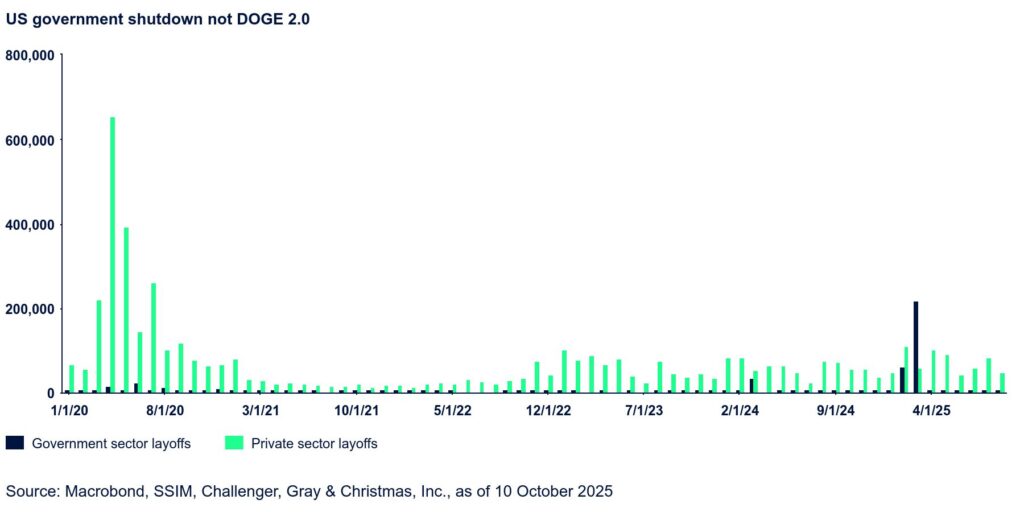

Additionally, news agencies report that permanent layoff notices have started going out to select government employees. These are different from the typical furloughs that happen during a government shutdown, where furloughed employees return to work once the government reopens and receive full retroactive pay. In this case, these appear to be permanent layoffs, similar to the ones that occurred early in the year under DOGE initiatives.

It is unclear how many employees have been impacted so far, nor how many more will be eventually affected. As of now, the numbers reported in the media are in the 5,000 range, which is a small fraction of what transpired in February and March. Nevertheless, given the broader labor market vulnerability—the hiring rate touched a 14-year low (ex-Covid)—there are risks associated with this approach.

These layoffs will also create additional difficulties in interpreting future labor market releases. We already expect a big drop in employment in October (linked to the DOGE deferred retirement program). This will make it marginally worse.