The consumer buffer thins

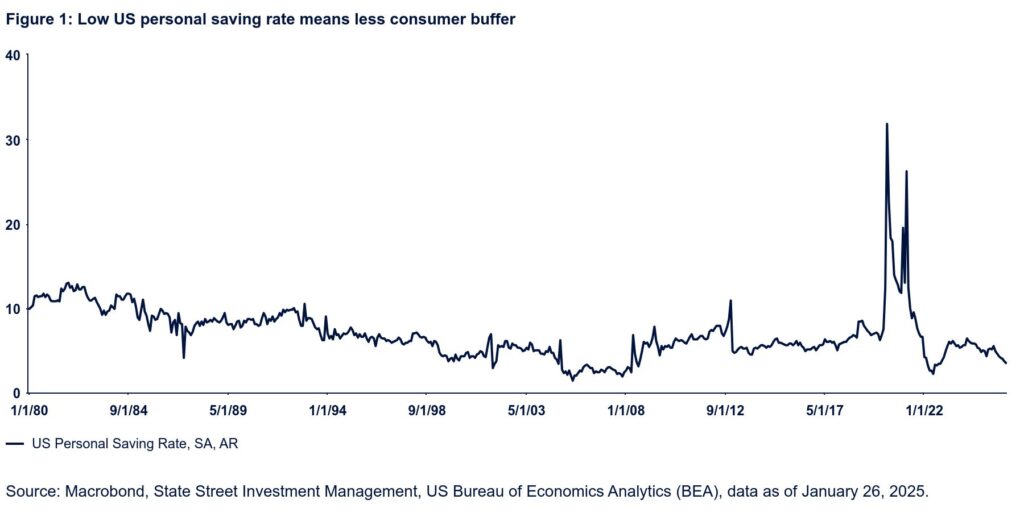

The concept of a K‑shaped economy has been percolating in macro commentaries for a while now, and with good reason. While strong wealth accumulation in the top income quartiles implies little downside risk to consumption in that space, the loosening labor market presents a more material threat for low‑income consumers whose incomes are primarily labor‑derived. New data this week put the household savings rate at just 3.5%, the lowest level since late 2022. It would be unwise to ring the alarm bells too loudly because in recent years such downshifts in the savings rate were subsequently alleviated by upward revisions to income, and this may happen yet again. What is different now, however, is that the labor market itself is at a much more precarious point, with job growth having slowed dramatically over the last nine months.

Nobody can tell how much of this reflects the effects of AI‑related labor displacement. However, we can be pretty sure that those effects will intensify, rather than dissipate, over the coming year. As such, a low savings rate highlights a potential consumer vulnerability insofar as a job loss in an environment of reduced savings could require more substantial consumption cutbacks.