We maintain our call for three cuts this year—75 bp worth of cuts—but we have pushed the first cut from June to July.

Fed Is Attentively on Hold

Sometimes, when things are just too complicated, the decision becomes simpler: do nothing, wait. That’s where the Fed is right now. We maintain our call for three cuts this year—75 bp worth of cuts, to be precise—which is roughly where the market is as well, but we have pushed back the first cut from June to July. The robust April employment report means no patients in the economic ward require urgent care, so for now there is no need to disburse the medicine.

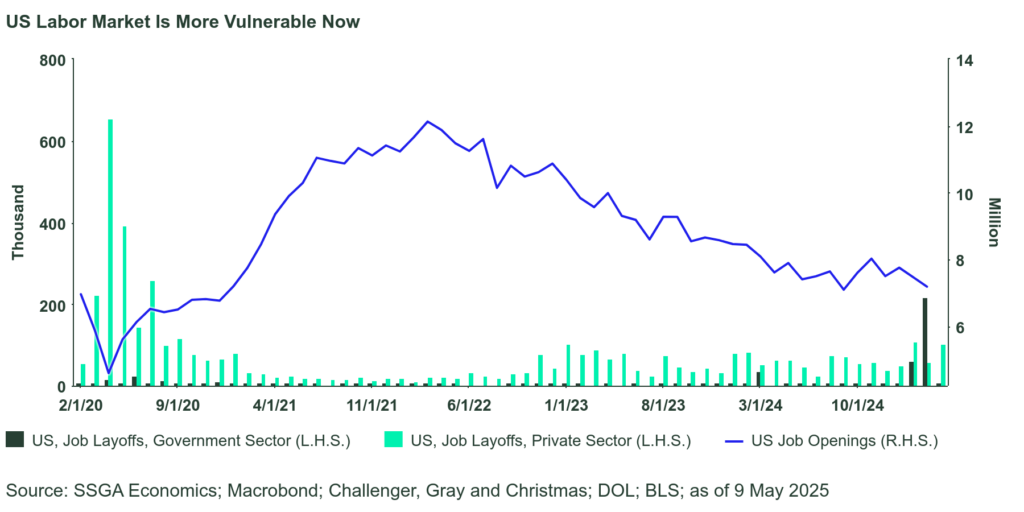

The current episode is reminiscent of a year ago, when the data suggested rate cuts were warranted yet the FOMC chose to wait, only to then go for a 50 bp cut in September. The same could happen here, although we still view that as the alternative scenario. Chair Powell was right in saying that in 2024 the unemployment rate was moving noticeably higher whereas it has now been hovering in a very tight range for many months. However, just as the Fed Funds rate was more restrictive in 2024 and thus warranted more aggressive cuts, the unemployment rate is already at what is considered to be the equilibrium level. Thus, the scope for letting it rise is much narrower. In fact, any move higher implies a departure from the labor market component of the dual mandate.

By the time of the July meeting (July 30), the 90-day deadline for reciprocal tariffs will have come and gone and there should be much more clarity on trade policy direction, not to mention more data in hand to assess current conditions. Any tariff relief (for China) or the avoidance of full tariff escalation (for others) would cut both ways: lower inflation risks, but also minimize growth risks. It should also allow the recent surge in inflation expectations to subside. In turn, this should facilitate some confidence among FOMC members that some further gentle reduction in policy restrictiveness (after more than a half a year on hold) can be pursued.