Unsurprisingly, US macro data continues to send mixed messages. Consumer sentiment improved following tariff relief, but personal spending cooled as consumers took a break following a torrid spending month in March. The labor market appears Unsurprisingly, US macro data continues to send mixed messages. Consumer sentiment improved following tariff relief, but personal spending cooled as consumers took a break following a torrid spending month in March. The labor market appears to be fraying further at the edges as continuing claims touched a new post-COVID recovery high. Housing demand remains challenged by unaffordability and uncertainty; the bright side is that house price inflation is cooling, and this may eventually offer a disinflationary impetus. First-quarter GDP growth was revised marginally better, but the economy still contracted 0.2% saar (seasonally adjusted annualized). Consumer spending, especially on services, was revised lower.

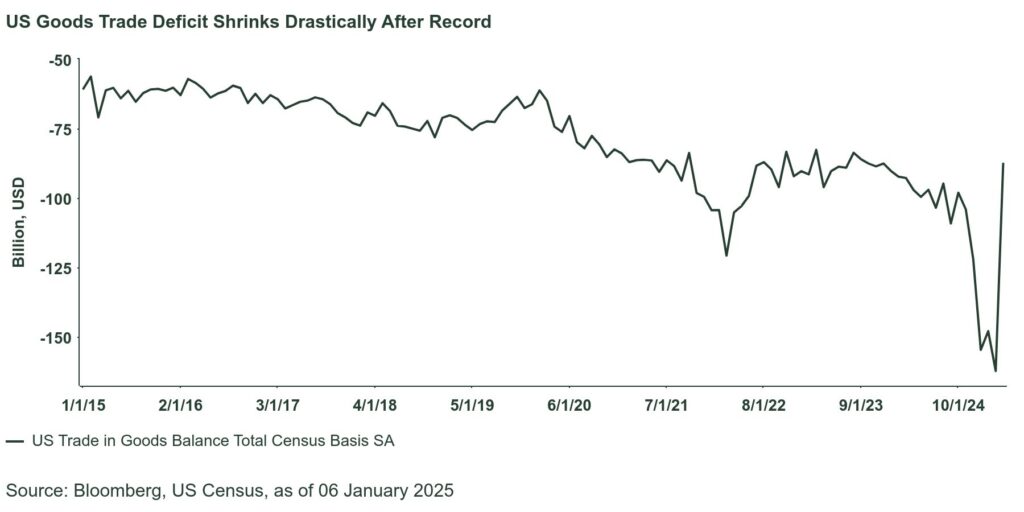

On the other hand, advanced trade data for April showed an incredible reversal in performance, with the trade deficit essentially halving to $87.6 billion. The gyrations in the trade data are quite extraordinary, but the latest information suggests that trade will contribute positively to growth in Q2, having been a major detractor in Q1. For what it’s worth, the Atlanta Fed GDPNow tracker rose to 3.8% saar on May 30, following the release of the trade data.

There was good news on inflation but, sadly, nobody is celebrating much given the likelihood that tariffs (some tariffs will undoubtedly survive the latest legal challenges) suggest the April inflation prints may be the lows for the year. Headline PCE (personal consumption expenditures) inflation and core PCE each moderated two-tenths to 2.1% YoY and 2.5% YoY, respectively. These were the corresponding lowest readings since February and March 2021.