The inflation updates for July have been mixed but remain perfectly compatible both with a Fed rate cut in September and further additional reductions. We maintain our long-standing call for 75-bp worth of rate cuts this year.

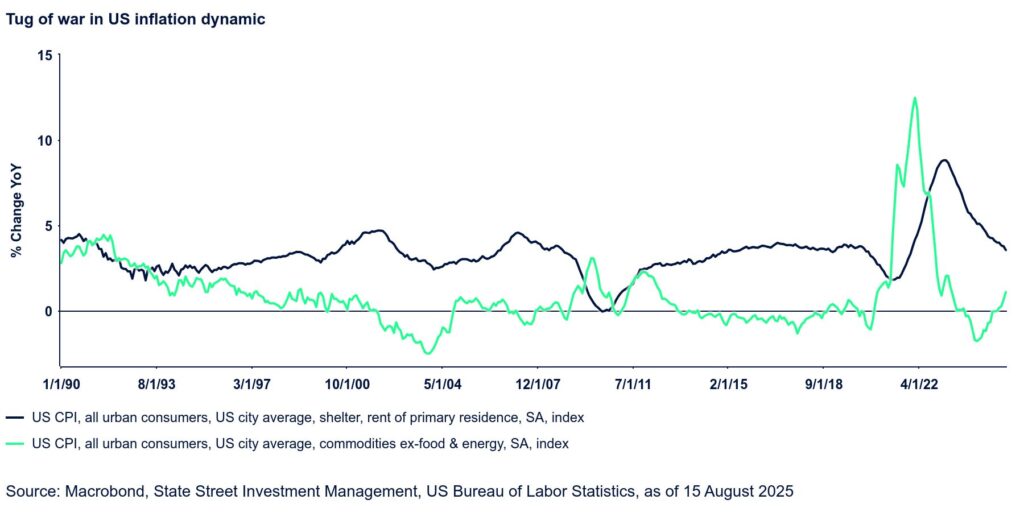

July’s consumer price inflation was in line with expectations, with overall prices rising 0.2% m/m and core prices (excluding food and energy) rising 0.3%. The headline inflation rate was unchanged at 2.7% y/y, while the core inflation rate rose two tenths to 3.1%. While the latter was a touch higher than expected, the number rounded up to 3.1% by the smallest of margins (0.02%). Within the details, goods prices were flat and services prices increased 0.3%. Goods prices were flattered by food (0.0% m/m) and energy (-1.1% m/m); core goods prices, on the other hand, increased by 0.2% m/m, the same as in June. New car prices were flat and used car prices rose 0.5%; this was the first increase in five months and likely to be followed by another given signals from auction prices. Airfares also rebounded sharply. Most importantly, perhaps, the news on the shelter front remains supportive, with disinflation continuing. Shelter costs rose a modest 0.2% m/m for the second month in a row (though this was a high 0.2%) and shelter inflation eased another two tenths to 3.6% y/y. We are counting on a few further tenth’s reduction here before year-end to counter further increases in goods prices.

The PPI release came in hot, with the headline inflation rate accelerating nine tenths of a percentage point to 3.3%. Goods inflation accelerated two-tenths to 1.9% and services inflation surged 1.3 percentage points to a four-month high of 4.0%. This was unexpected, but we suspect it may have to do more with base effects and seasonal adjustment anomalies than a broad-based resurgence in services inflation. The reason is that last year PPI services inflation dipped a full percentage point between June and July, before increasing again thereafter. As such, it could be a timing anomaly to some extent so the 3.4% average of last two months of services PPI inflation is perhaps a better gauge of underlying trend.

After two sizable declines, inflation expectations ticked up again in the preliminary University of Michigan survey, which is likely why the sentiment measure deteriorated. Short term (1-year) expectations increased four-tenths to 4.9% and long-term (5-10 year) expectations rose five-tenths, putting them roughly back where they were in June.

The combination of the hotter-than-expected PPI data, rebound in inflation expectations, and a decent July retail sales print caused traders to trim scale back rate cut expectations, though September remains almost fully priced. We continue to believe both that 75 bp worth of cuts this year is the right policy move, and that the Fed will actually deliver them. Figure 1 above is a reminder that US inflation is about a lot more than just goods and tariffs and ongoing shelter disinflation offers a powerful tariff offset. Moreover, while jobless claims have once again flatlined, they are almost guaranteed to take another step higher in October as the federal government employees who took the deferred layoffs deal come to the end of that arrangement. It is possible that many could move straight into new employment, but that all of them, would do so seems unlikely. Jobless claims will rise as a result. With nine months having passed since the last cut, the FOMC is well positioned to resume the rate cutting cycle in September.