US housing sentiment surges after Fed rate cut

Housing stirs amid resumption of rate cuts

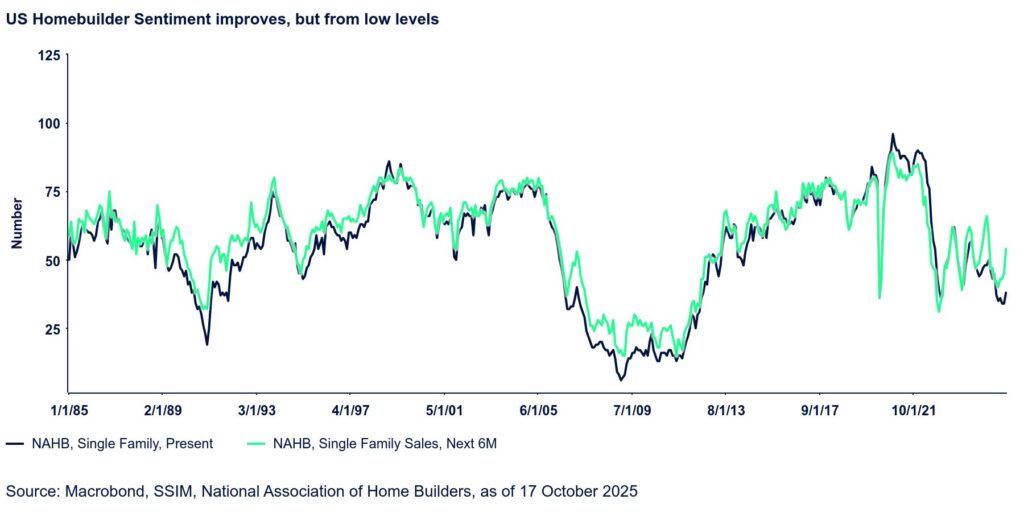

Amid the ongoing government shutdown, the flow of US macroeconomic data has been limited to a few private data releases. Of these, perhaps the most hopeful this week was the update on homebuilder sentiment from the National Association of Homebuilders (NAHB). The 5-point jump in the headline was the largest single-month increase since January 2024 and highlights the sector’s sensitivity to the resumption of Fed rate cuts. Specifically, the “future sales” component surged nine points, also the most since January 2024.

Given our (and market’s) expectation for two more 25-bp cuts this year and more in 2026, it is not surprising to see sentiment around future home sales improve. While 30-year mortgage rates remain elevated at around 6.25%, they should ease further in coming months, improving affordability. The other side of this, of course, is that current sales activity is so depressed that it would not take much to bring about an improvement. Indeed, present sales sentiment is hovering at levels seen only briefly during COVID.