December cut not guaranteed, but likely

The FOMC delivered another 25 bp rate cut this week, as was widely expected. That came with some hawkish strings attached, however, as Chair Powell made it a point to emphasize during the press conference that another reduction in December is “far from a forgone conclusion”. Governor Miran dissented again in favor of a larger (50 bp) cut, but Kansas Fed President Schmid dissented in favor of a hold. The environment of “strongly differing views” that the Chair described was well reflected in this combination. Market participants trimmed bets on a December cut from almost 100% before the meeting to about 70-75% as of Thursday and then further to about 63% after Lori Logan of the New York Fed said Friday that she also opposed the October cut. She is not a voter, but every opinion counts in what is undoubtedly setting up to be a heated debate in December.

The Fed also announced the end of balance sheet runoff effective December 1 and announced plans to reinvest maturing MBS holdings into Treasury bills. It had been broadly expected that the Fed would soon move to end QT, so there were no shocks here.

All eyes now turn to the December meeting. We expect a cut at that meeting, but the lack of timely data makes this a trickier call than it should otherwise be. For the time being, the Fed can look to existing statistics on state level unemployment claims, private sector data on job postings, and other complementary sources, but in the absence of the household employment survey, it is difficult to gauge what is occurring on the labor supply side and whether the “low hiring low firing” balancing act is still keeping the unemployment rate steady. We think it would be better for the Fed to take one more dose of insurance against the labor market soft patch before settling into an extended pause during the first few months of 2026. Moreover, the 1-year trade truce with China materially lessens concerns about a delayed inflationary impact of tariffs and should allow the FOMC to better trust existing evidence of modest pass-through. Finally, this approach could also create some buffer around the selection of the new Fed Chair.

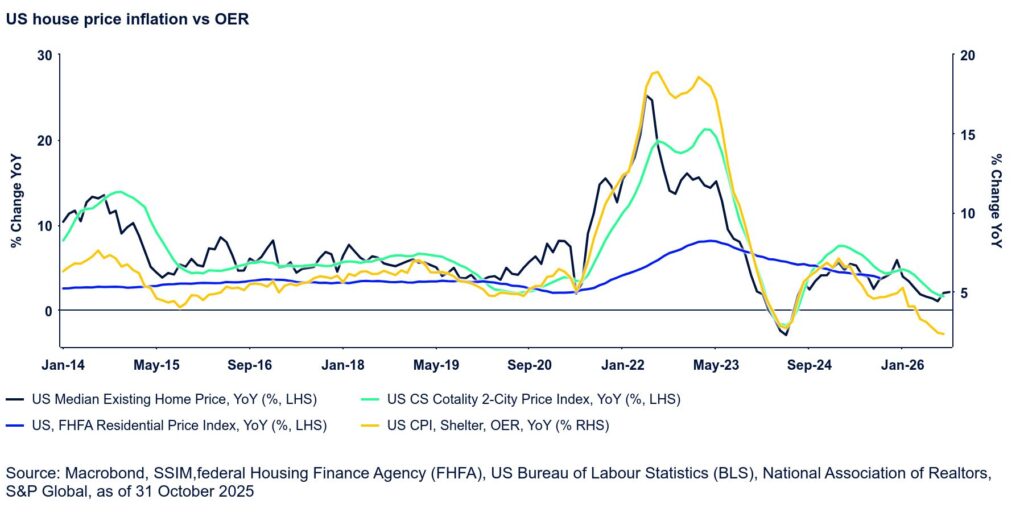

Aside from concerns about weakening labor demand, another key element in our argument for further easing is that there is every reason to believe that there is further disinflation in shelter costs. Both market data for rent and house prices suggest we can get further relief from here and that can continue to partly offset tariff impacts (figure below).