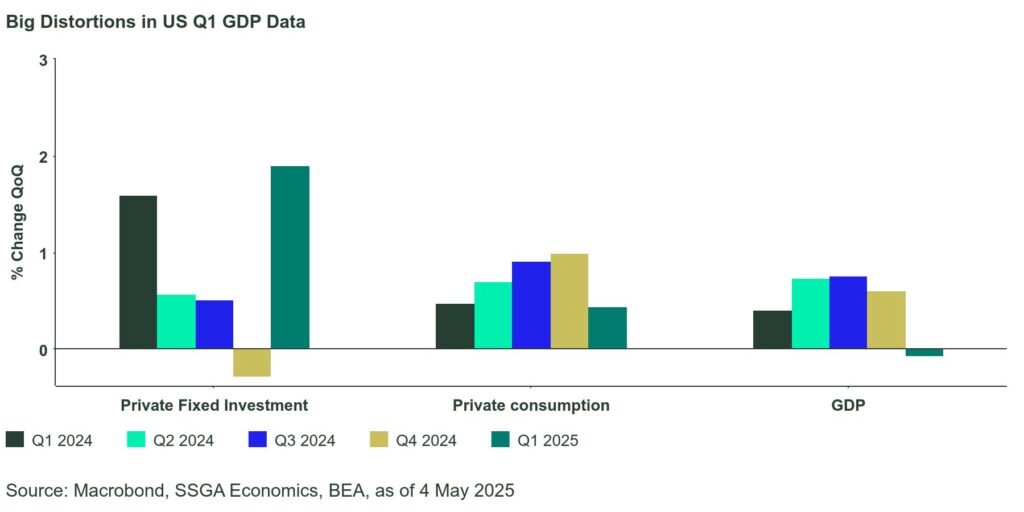

The US economy contracted at a 0.3% seasonally adjusted annualized (saar) pace in the first quarter, the first such decline since the start of 2022. Given the massive crosscurrents at play, the outcome was impressively close to consensus expectations (-0.2% saar). It is, however, a very incomplete story of the underlying dynamics. In a nutshell, private consumption slowed but remained resilient, fixed investment jumped, inventories surged, and net trade collapsed. In contrast to GDP, final sales to private domestic buyers—a less volatile metric that tracks underlying domestic demand conditions—grew 3.0% saar, a tenth faster than in Q1.

Consumer spending—the backbone of the economy—grew 1.8% saar, driven heavily by services. Spending on goods was soft, up just 0.5% saar, suggesting that consumers themselves were not actively bringing forward purchases. However, spending on goods was extraordinarily strong in both Q3 and Q4 so the Q1 moderation must be understood in that context. As for the one area of goods consumption where some tariff front-running had been visible, namely motor vehicles, the surge started in March and was overwhelmed in the quarterly data by the weak January-February readings. This will likely reverse in Q2.

In fact, the entire consumer spending dynamic for the year as a whole may prove counter intuitive. The starting point for consumer spending is so elevated that even with meager sequential readings, the 2025 average may betray much less softening than generally expected. It is why we remain materially more upbeat than consensus on 2025 consumer spending (2.4% versus 1.8% consensus) and why our full-year 2025 GDP forecast is similarly above consensus at 1.7%.

Companies, on the other hand, had been in a rush to front-run tariffs, proven by the astonishing 50.9% saar surge in goods imports in Q1 (Figure 2). This had only been topped once in the past, in Q3 2020, right after lockdowns ended.

That US ports have been able to handle such a surge in traffic with no sign of stress demonstrates an admirable degree of operational efficiency that is a world apart from the Covid experience. For example, at the peak in Q4 2021, ships in the port of LA waited about a month at anchor and berth to be unloaded. In Q1 2025, the wait time was under five days; with little indication of any increase as tariffs drew near.

One wonders how Q2 will fare; given the 90-day delay in reciprocal tariffs ex-China, import flows could remain brisk for a while longer. Nonetheless, inventories surged by $140 billion in Q1, by far the biggest accumulation outside of Covid and with the exception of seasonal consumer goods, a decent inventory cushion has probably already been built.

It is clear given the dramatic extremes witnessed already, that quarterly growth performance could be very uneven over the course of 2025. But we would not be surprised if Q1 actually marks the peak US underperformance relative to the eurozone, whose economy reportedly grew 1.4% saar in Q1.

The labor market resilience so far is welcome and supports our no recession call. The economy added 177k jobs in April, although this was accompanied by a 58k downward revision to the prior two months. There were no real surprises in the sector distribution; the unemployment rate held at 4.2%. Average hourly earnings increased 0.17 m/m, the least since February 2022, and were up 3.8% y/y. in other data, core PCE inflation eased to 2.6% y/y. While we do expect core PCE inflation to rise again towards 3.0% in Q4 as tariffs feed through the economy, we see room for the Fed to calibrate rates lower to defend both sides of the dual mandate. There is little indication of wage-related inflationary pressures and the surge in consumer inflation expectations could subside fairly quickly if trade deals are reached.