Ongoing labor market softness

The dense data fog that had descended upon the US economy due to the prolonged government shutdown is finally starting to lift. New labor market updates this week confirm a backdrop of softness without acute weakness.

Nonfarm payroll employment rose a weaker-than-expected 50k in December, but the bigger story perhaps was the big downward revision to the October estimate, which now indicates a net loss of 173k jobs that month, compared with the 105k decline reported previously. While this is water under the bridge to some extent, it does better match our own estimates of the ultimate impact of the DOGE deferred layoffs announced in the spring but effective in October. The latest data point to job losses averaging 22k per month in Q4 2025.

Performance is poised to improve from here, if for no other reason that there is no DOGE 2.0 on the horizon, but the trend of soft labor demand is here to stay, as evidenced by another drop in job openings. Without a pickup in labor demand, there can be no pickup in hiring. Constraints to labor supply (mostly via immigration) will likely be the factor keeping the unemployment rate in check, although we believe risks are clearly to the upside. The unemployment rate ticked down a tenth to 4.4% in December (November was also revised down by a tenth to 4.5%) but hours worked remain weak and imply more vulnerability under the surface. Wage data was somewhat mixed, with overall average hourly earnings (AHE) inflation up two tenths to 3.8% YoY but AHE for production and non-supervisory employees down to 3.6% YoY, an almost four-year low.

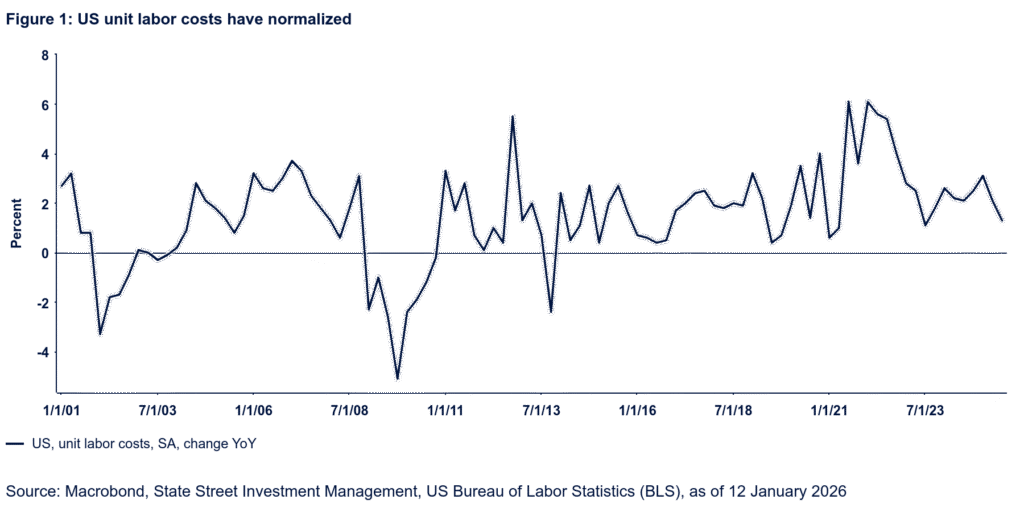

The takeaway here confirms Chair Powell’s assertion over the last few months that the labor market is not a source of meaningful inflationary pressures. If there was any lingering doubt about that, the Q3 update on productivity and labor costs should dispel it. In truth, we are somewhat perplexed by the strength of consumer spending in the Q3 GDP data, and any future downward revisions may alter things at the margin. But, based on current data, labor productivity surged at a 4.9% annualized rate in Q4, keeping unit labor costs growth into negative territory for the second consecutive quarter (‑1.9% QoQ SAAR). Still, these recent declines must be interpreted in the context of the Q1 surge. On a YoY basis, unit labor costs have normalized in a non-inflationary range but are by no means collapsing (Figure 1).