US data remains resilient with bullish undertones for risk assets, as PCE inflation aligns with expectations.

Undertones of resilience in US data

Essentially every US data release this week came in stronger than anticipated. A big surge in new home sales in August, an upward revision to the final read on Q2 GDP (from 3.3% to 3.8% seasonally adjusted annualized), a beat on consumer spending and a decline in unemployment claims, all equated to an overall message of macro resilience.

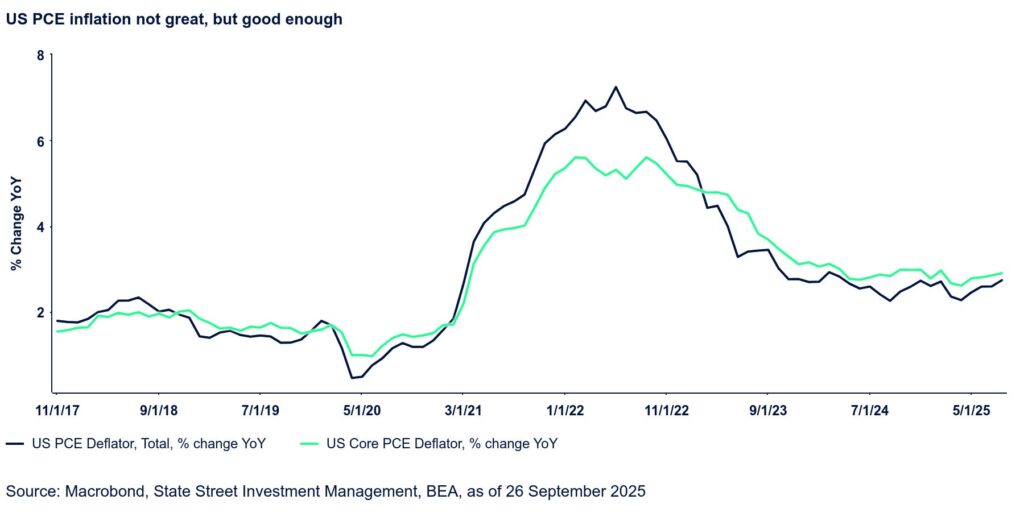

Importantly, the two inflation data points released this week—PCE deflator and the University of Michigan consumer inflation expectations updates—were both in line with or even better than expected. Relative to the preliminary release, both the short- and long-term inflation expectations in the Michigan survey were a little softer (though still higher than the month before). The PCE inflation updates, so closely watched in the context of the Fed’s renewed easing cycle, were also encouraging. Admittedly, overall PCE prices rose 0.3% MoM on sizable increases in both food and energy, but core prices advanced a more modest 0.2% and the prior month was revised a touch lower. Headline PCE inflation stood at 2.7% YoY in August while core PCE inflation was steady at 2.9%. Both were in line with our expectations. We suspect only minimal further increases from here through year-end, which should allow the Fed to deliver on the two remaining rate cuts embedded in the latest dot plot for 2025.

The critical question is whether this momentum continues. We suspect it may be broken at some point over the next several weeks, at least in regard to labor market data. As former government employees who took advantage of the DOGE deferred resignation program come to the end of that arrangement, initial unemployment claims should start to move higher again over the course of October. We look at this as a soft patch with the Fed easing helping to stabilize labor market conditions but worries about a recession will likely revive again.

US PCE inflation not great, but good enough