There is not much new to say that we haven’t said in these pages over the last several months. Our long-held view that the labor market was softening was the basis for our similarly long-held call for three Fed rate cuts this year. Prior to the big downward revision to payrolls in early August, the market did not seem to agree with our read of the data. But with a fourth consecutive weak labor market report in hand, the market has moved to fully price a September cut and almost three cuts by year-end. For our part, we stick to 75 bp worth of cuts as the baseline forecast, but now begin to consider the possibility of 100 bp. If the October payrolls (released early November) are as weak as we expect them to be (reflecting the deferred DODGE deal for government employees whose formal employment ends in September), anxiety about the direction of the labor market may set in and spark more aggressive cuts. Again, we do not change our official forecast, but highlight this as a new possible scenario.

Back to the August jobs report. It was not disastrous, but it was soft. Nonfarm payrolls increased by 22k (a third of the expected number) and there was a 21k downward revision to the prior two months. The private sector added 38k jobs, the government sector lost 16k. Within the private sector, education and healthcare and leisure and hospitality continue to lead gains, but retail also added 11k (we find this a little surprising). On the other hand, goods-producing sectors lost 25k jobs, and professional and business services lost 17k.

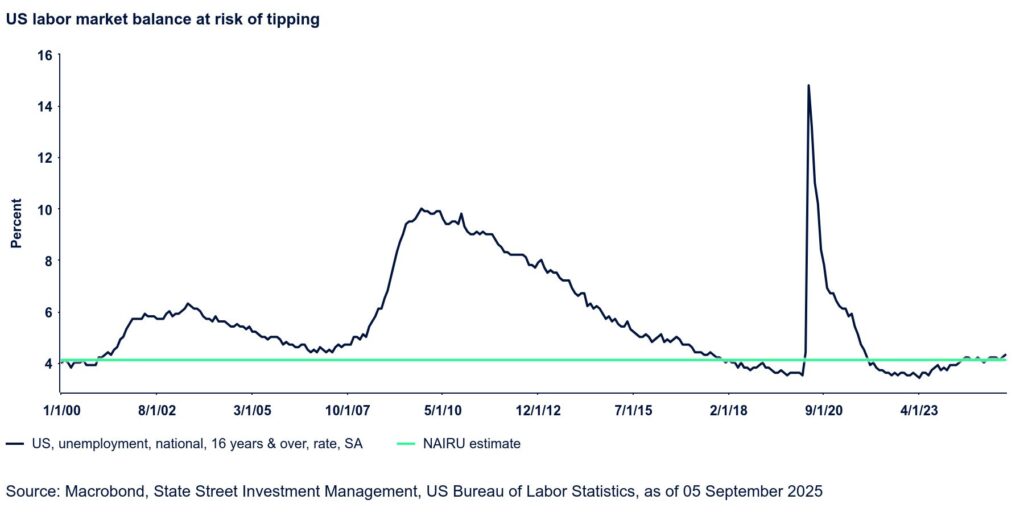

The participation rate ticked up a tenth, but it is still low at 62.3% and the unemployment rate rose a tenth to 4.3%, the highest since October 2021. The aggregate hours index was unchanged, but manufacturing hours worked declined. Average hourly earnings (AHE) increased by 0.3% MoM for the total employee population and by 0.4% MoM for production and non-supervisory employees. Despite these fairly robust gains, the two respective measures of wage inflation were well behaved. Total AHE inflation actually eased two tenths to 3.7% and AHE inflation for production and non-supervisory employees held steady at 3.9% YoY.