It has been clear for a while that the 2025 spring home buying season was going to be rather uninspiring. Additional data this week confirmed this assessment. Admittedly, new home sales surprised positively in April with sales at 743k annualized, but this was largely offset by a big downward revision to the March data, such that January–April sales are still marginally (0.8%) lower than a year ago.

Lower demand is meeting increased supply, with the overall supply of new homes hovering around 8.5 months’ worth of sales—an elevated level from a historical perspective. Moreover, within that overall supply, the number of already completed homes available for sale has continued to rise, even as builders have adopted a more cautious approach to inventory management. The result has been mild downward pressure on prices, which could persist amid elevated mortgage rates. But high construction costs provide a floor here.

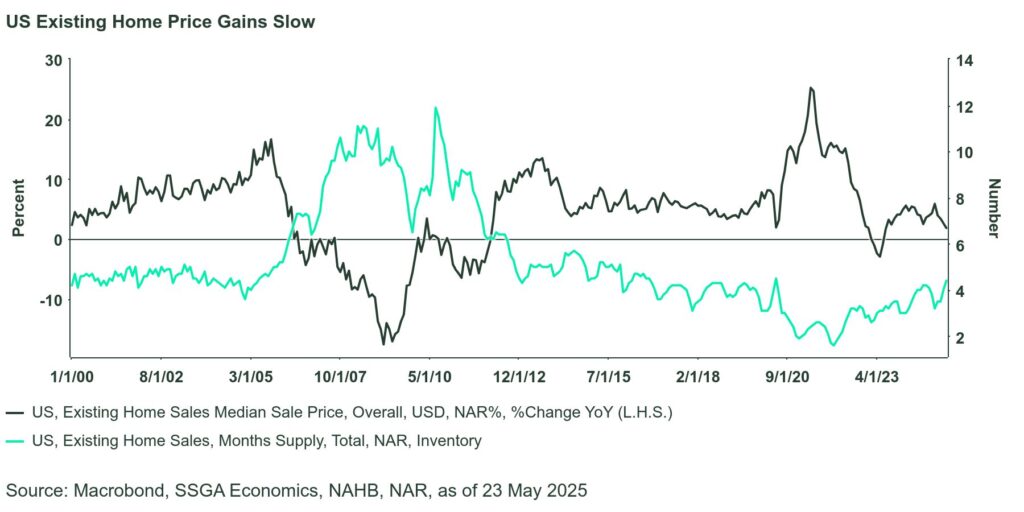

The news is not any better in the existing home market either. Existing home sales came in at 4.0 million seasonally adjusted annualized (saar), down 2.0% y/y. The supply of existing homes reached 4.4 months’ worth of sales, the highest level since May 2020 and, prior to that, September 2016.

Unsurprisingly, given the supply-demand dynamics, the pace of home price appreciation continues to moderate. The median price of an existing home rose just 1.8% y/y in April.

These dynamics speak to some offsetting inflation developments in parts of the economy that are not directly affected by tariffs and are an important reason why we see a more benign inflation impact from tariffs than the consensus.