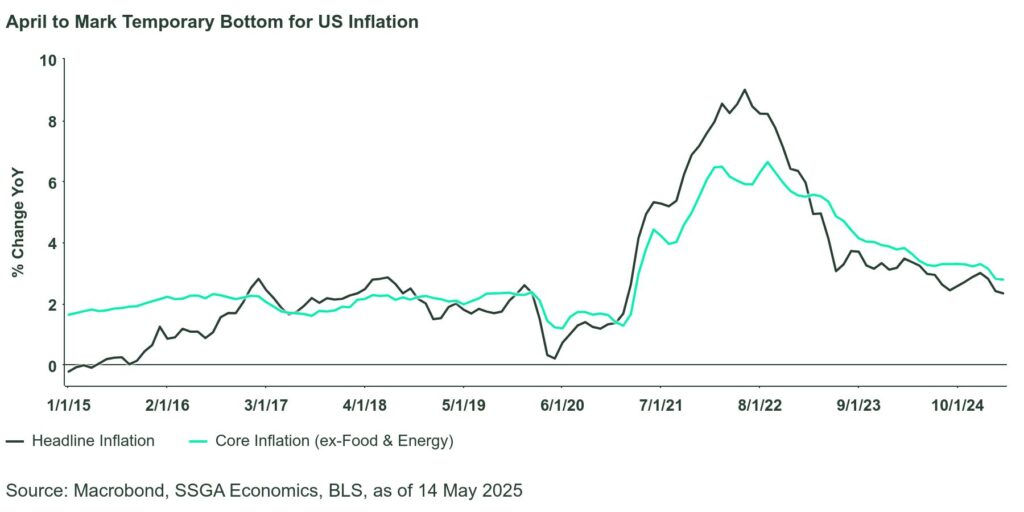

Both overall and core (excluding food and energy) consumer prices rose by 0.2% MoM. This allowed the headline inflation rate to ease to 2.3% YoY, while the core inflation rate remained unchanged at 2.8% YoY. These figures are the lowest since early 2021. However, these numbers are likely to be local bottoms due to challenging base effects and the impact of tariffs in the coming months.

OK Inflation, More Tariff Relief

Last week we said that the April inflation data could be a slight dovish surprise; the data this week confirmed that expectation. Both overall and core (ex food and energy) consumer prices rose 0.2% m/m, allowing the headline inflation rate to ease a tenth to 2.3% y/y and keeping the core inflation rate unchanged at 2.8% y/y. For headline, this was the lowest print since February 2021; for core, the twin-lowest since March 2021. That being said, these numbers are almost guaranteed to mark local bottoms for each of these series due to difficult base effects and tariffs impact over the next several months. Nevertheless, with the labor market already in balance, tariff risks greatly diminished amid ongoing negotiations, and the Fed Funds rate still in moderately restrictive territory, we very much continue to believe that the Fed should calibrate rates lower.

The details were perhaps less dovish than the headline. Goods prices were flat and service prices rose 0.4%, double the March rate. In addition to energy services, medical care services were a big driver, with prices jumping 0.5% m/m. Shelter prices increased 0.3% m/m, with OER up 0.4% m/m. Other, more discretionary areas of services were better behaved, with recreation flat and airline fares down 2.8% m/m. Food prices were bifurcated: Food at home prices declined 0.2% m/m, reflecting—among others—a big drop in egg prices (we think there is room for further reductions) while food away from home prices rose another 0.4% m/m. Energy prices increased 0.7%, largely on the back of a sizable increase in piped gas services. This was somewhat at odds with gas price behavior but may reflect delayed passthrough of prior cost increases.

Much more important than the April inflation data was the announcement of tariff de-escalation with China. In the April 14 Weekly Economic Perspectives we wrote the following: “The further increase in US tariffs on China (to 145%) and retaliatory Chinese tariffs on the US (125%) is no ‘joke’; it is very serious business, but not good business. We argued that the April 2 tariffs were unsustainable, and we argue the same here. There are many valid grievances that the US has vis-à-vis China’s trade practices. However, imposing tariffs of this magnitude goes far beyond making the point; it actually diminishes it. And so, we look forward to a near-term de-escalation so that meaningful negotiations can unfold. At the end of the day, the world needs the US, the US needs the world, and we all need trade.” The announcement this week of a 90-day delay in reciprocal and retaliatory tariffs between US and China bring back a sense of normality to global trade. It may be a fragile equilibrium, but the 90-day negotiation window is not just a holding place – its purpose is to turn it into something more robust. We remain watchful, but we are doing the watching with much less oppressive anxiety.